Changes to National Minimum/Living Wage

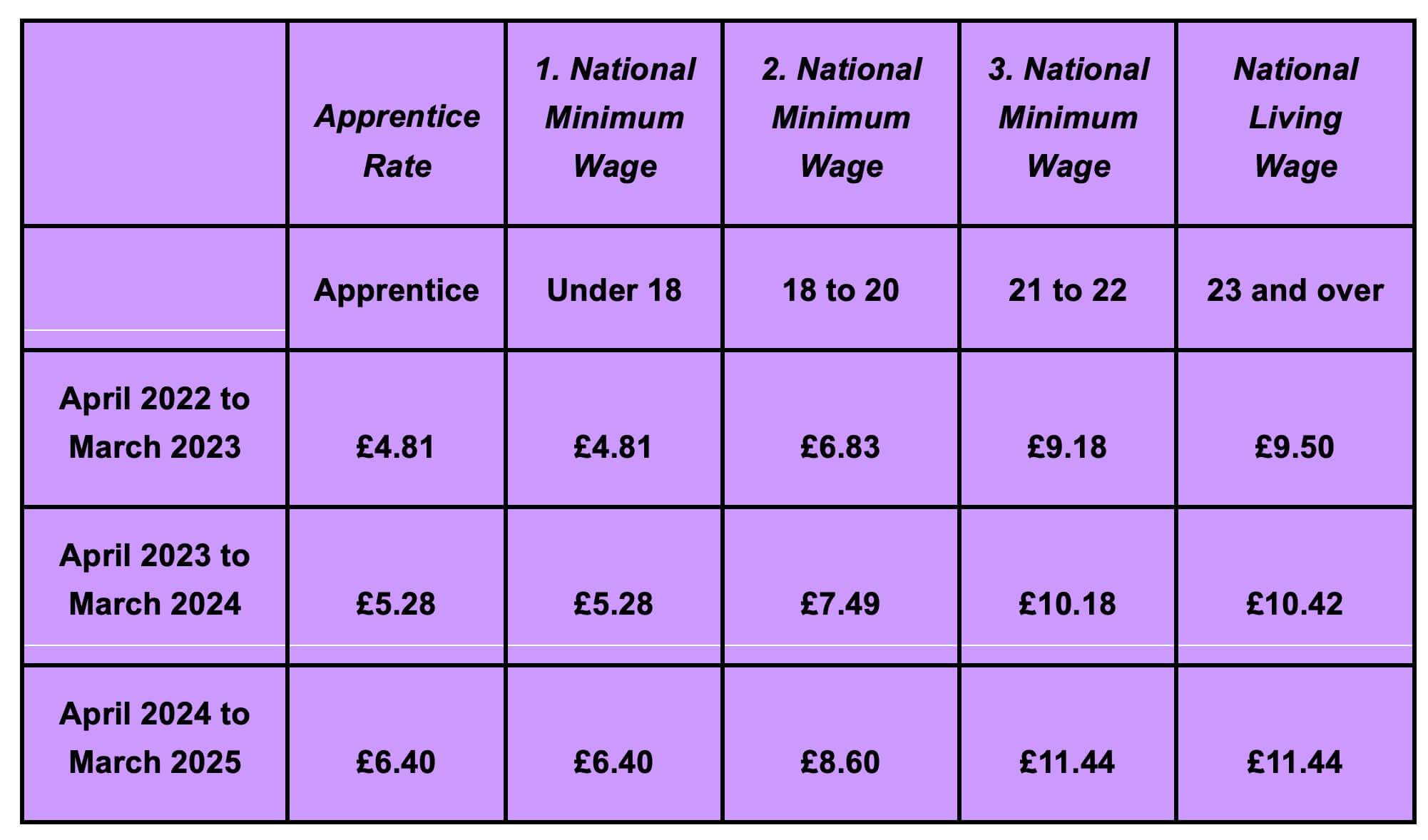

Following the government’s policy, agreeing to advice from the Low Pay Commission, they will continue to affect an increased percentage rise to National Minimum Wage, which will take effect from 1st April 2024.

National Minimum Wage presently applies to those that are under the age of 23 and at least of school leaving age. National Living Wage applies to those that over 23. However, this will change in April 2024 as National living Wage will incorporate those aged 21 and over.

National Minimum Wage, presently £10.42, will increase by 9.8% to £11.44 per hour. In addition, it was also confirmed that the age for NMW, presently 23, would be reduced to 21. Also effective from 1st April 2024.

This rate also applies to part-time or casual workers, workers in training and offshore workers.

Workers not subject to National Minimum Wage include Self-employed workers, unpaid volunteers, company directors and members of family cohabiting with their employer.

Minimum Apprentice Wage

The Minimum Apprentice Wage, presently £5.28 will increase to £6.40 from April 2024

An apprentice must be aged under 19 or if over 19 in their first year of their apprenticeship.

Note that if an apprentice is 19 or over and has already completed their first year of their apprenticeship, then they will be entitled to the National Minimum Wage for their age.

(ie: for a 20-year-old apprentice in year 2 of their apprenticeship, after April 2024 they will be entitled to be paid £8.60 per hour)

Accommodation Offset

Accommodation provided by an employer can be taken into account when calculating the National Minimum Wage or National Living Wage.

No other kind of company benefit (such as food, a car, childcare vouchers) counts towards the minimum wage.

The present Accommodation offset rate is £9.10 (£63.70 per week) and this will increase to £9.99 from April 2024 (£69.93 per week).

Please be aware that if an employer charges more than the offset rate, the difference is taken off the worker’s pay which counts for the National Minimum Wage or National Living Wage.

This means the higher the accommodation charge, the lower a worker’s pay when calculating the minimum wage.

However, if the accommodation charge is at or below the offset rate, it does not have an effect on the worker’s pay.

If the accommodation is free, the offset rate is added to the worker’s pay.

For more details you can follow this link: https://www.gov.uk/national-minimum-wage-accommodation/print

IMPORTANT: Please make sure your payroll software is updated to reflect these changes and we recommend that you review all of your employee’s wages and salaries to ensure that you are meeting the National Minimum/Living Wage

Please do not hesitate to call JLP Payroll Services if you have any questions.