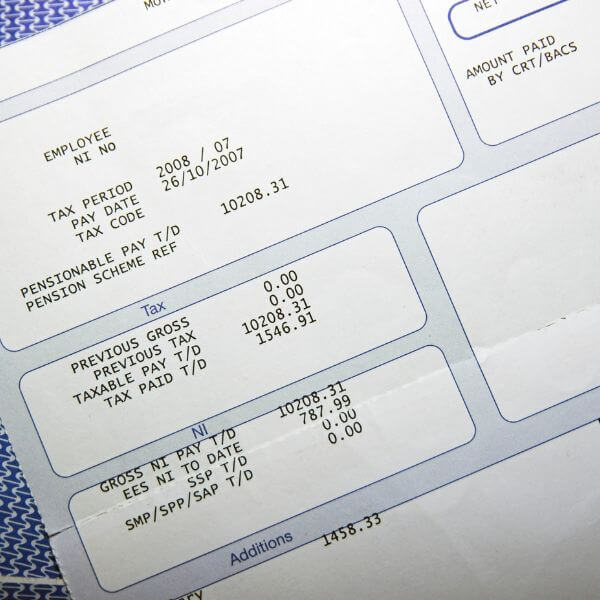

Real Time Information, or RTI for short, is HMRC’s scheme for Payrolls, originally introduced in April 2013.

It is intended to improve and streamline the flow of payroll, National Insurance and taxation information between employers and HMRC, by requiring information to be submitted BEFORE staff are paid, regardless of whether they are paid weekly, fortnightly, 4-weekly or monthly. You could call it the introduction of real time payroll.

All businesses are required to comply with RTI rules and it’s your responsibility to make sure that your company is on board, or you may suffer hefty penalties, for non-compliance. In addition, any amendments to payroll require a supplementary RTI, showing the corrections, to ensure that the payments for your companies PAYE are calculated correctly.

There are certain situations when an Employer Payment Summary (EPS) must also be created and submitted to HMRC. These situations all focus around claiming refunds/recoverable amounts from HMRC or making declarations to HMRC. If required, an EPS must be submitted by the 19th of the following tax month, for HMRC to apply any reduction.

Just like running your own payroll, RTI plus associated submissions, such as EPS, can be a lengthy and time-consuming process and could mean a lot of extra work. Do not despair, if you’re already one of our clients, here at JLP Payroll Services we are fully RTI compliant and we will do it all for you, so you can get on with running your business. We guarantee you will have peace of mind knowing that your payroll is being run correctly and complies with HMRC’s Real Time Information – RTI – requirements.

If you’re not already one of our clients, by transferring administration of your payroll you will also benefit from our expertise with RTI.

Contact us now to find out how JLP Payroll Services can help your company.

Find Out More

Find out how JLP Payroll can help streamline your business.